Financing rooftops from the ground up

About Rooftop Capital

Rooftop Capital is a private real estate finance company with a singular focus: To be the development capital provider of choice for the housing industry’s most successful homebuilders and developers.

Rooftop Capital was co-founded by Glenn Watchorn and Jeremy Scheetz, industry veterans with a long and successful track record within the U.S. and Canadian residential development finance space, alongside a large family-office with a multi-billion dollar balance sheet and a deep history of real estate development and asset management throughout the United States and Canada.

Our strategy is straightforward. Rooftop Capital adheres to fundamental analysis for underwriting all loans and investments, starting with a top-down approach. First, we target high-growth markets and submarkets with low supply, high liquidity and better overall security. Second, we leverage our long-standing relationships to partner with large, best-in-class homebuilders and developers with deep local knowledge of their markets, housing products and homebuyer customers to structure safer transactions and create a business flywheel. Third, we hand-pick low-risk development projects with high-demand product offerings to maximize success.

We believe this strategy provides the most compelling risk-adjusted returns for our investors on an unleveraged basis in relation to any other real estate investment asset class.

Most compelling risk-adjusted unlevered returns in real estate

Low Risk

Investing in high-growth housing markets with low supply and high liquidity reduces risk for our investors.

Experienced

Management’s experience and established relationships with best-in-class homebuilders and developers further mitigates risk and creates a business flywheel.

Selective

Focusing on low-risk development projects and high-demand housing products optimizes long-term success.

Financing

U.S. Homebuilder Lot Banking

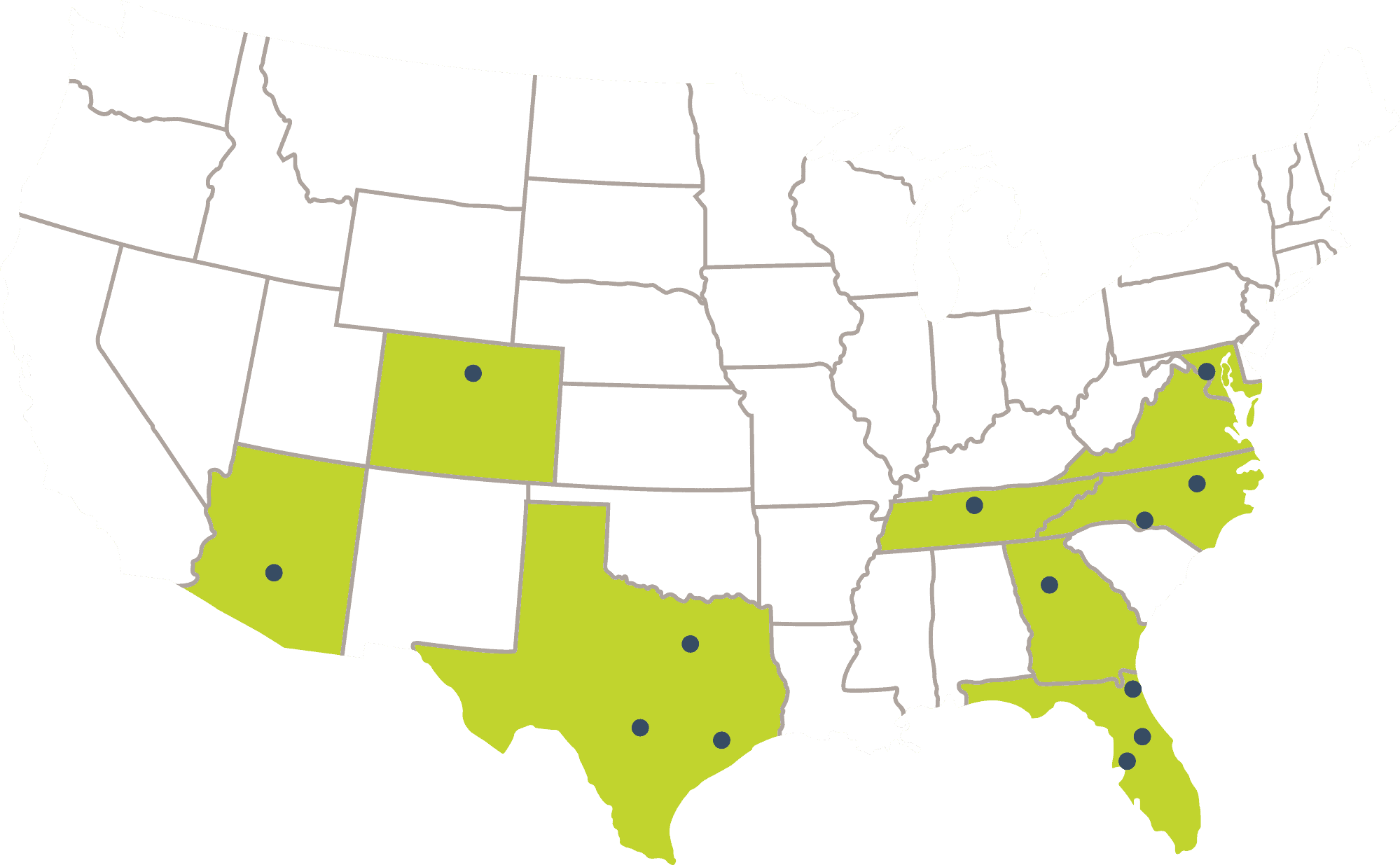

Rooftop Capital provides off-balance-sheet single-family lot development financing (“Lot Banking”) for large U.S. public and private homebuilders within high-growth and supply constrained U.S. Sunbelt housing markets.

Illustrative Terms- Size: US$10-30+ million

- Advance: 80-85% of cost (15-20% homebuilder deposit)

- Rate: SOFR + 7-9% (fixed or floating with floor)

- Fees: 1% commitment fee

- Term: 2-4 years

U.S. Residential Land A&D Loans

Rooftop Capital also provides first mortgage residential land acquisition and development (“A&D”) loans to experienced single-family lot developers and master-planned community makers within high-growth and supply constrained U.S. Sunbelt housing markets.

Illustrative Terms- Size: US$10-30+ million

- Advance: up to 75% LTV / 80% LTC

- Rate: SOFR + 7-12% (fixed or floating with floor)

- Fees: 2-3% commitment fee

- Term: 2-4 years

Other Financing Products

The Rooftop Capital team has decades of experience in lending and equity investing throughout the United States and Canada in many other for-sale and for-rent development asset classes, including development and construction of single-family and multi-family housing, master-planned communities and mixed-use projects. We will consider other financing opportunities such as A/B financing, mezzanine loans, preferred equity and joint-venture equity on a select basis.

Markets

Leadership

Team

Rooftop Capital is comprised of a unique and talented team of individuals with many years of real estate, development and finance experience, including a long and successful track record of working together within the U.S. residential development finance space.